Flex Space Perspectives

Yardi is excited to present a series of bitesize insight videos in partnership with Property Week, ahead of Workspace 2020. This series of interviews gathers perspectives from all corners of the flexible workspace industry, reflecting on the uncertain times that we have found ourselves in during recent months.

Justin Harley, regional director at Yardi, captured insights from design company Area, flex space operator Uncommon and data analytics company The Instant Group. In the last of the series, Harley also summarised Yardi’s technology outlook.

How will physical space differ in the future post-covid-19?

First to take the Zoom stage, was Kathryn O’Callaghan-Mills, Design Director at Area. Harley jumps straight in with the burning question, “how will physical space differ in the future post-Covid-19?”

“The beauty of workspace is that it is so flexible, and the key point of our industry is to give the user a flexible experience,” comments O’Callaghan-Mills. “Operators need to consider two main elements; people and space.” O’Callaghan-Mills explains how operators can make an impact by considering these two pertinent points, including enabling social distancing with space management and rotating people within those spaces.

Staying true to the bitesize theme, O’Callaghan-Mills promotes a digestible way of thinking with a ‘the now, the next, and the future’ mindset. With ‘the now’ comprising of immediate measures you can take; ‘the next’ acts as a hybrid of the immediate measures and new normal measures; and ‘the future’ which leverages on the innovation and technology investments you make today.

How will the landscape of flex space change?

Harley also spoke to Chris Davies, Director of Uncommon. Davies expressed that “the traditional faceless office is dead.” And how “the real estate industry needs to support the needs, amenities and service demands of flex space clients.”

“Covid-19 has fundamentally changed the landscape – it’s sped up pre-existing trends such as looking after staff. Staff are the most important part of any business and make up 60-80% of most businesses and flexible office space is the corporate enabler.” Davies explained that office users want a healthier workspace and activity-based working – something that the flex space market has a hold on over traditional office.

Davies expressed how corporate companies will continue to absorb the majority of flex space market. In 2019 40% of occupiers were corporations – Davies only sees this expanding.

Companies signing 5-10-year lease agreements will be a thing of the past in Davies’ opinion. “why wouldn’t a business use a better environment for their staff?”

How will the demand for flexible workspace differ post-Covid-19?

James Rankin, Head of Research for The Instant Group, gave some insightful perspectives on how the demand for flex space might differ post-Covid-19. Rankin broke his summary down into three main points explaining that demand for corporates will increase, diversification of location of the office portfolio will be prevalent, and the entrepreneurial sector will flourish.

Rankin shared insights from a recent research project conducted by Gartner; “Flex space operators are moving away from the reactionary thought process that Covid-19 has seen them take, and are now moving to make more strategic decisions about the future of flexible workspace. They are looking to reduce costs, make efficiencies and increase the flexibility of their portfolios as a whole.”

Diversification of the office portfolio will be ever more important Rankin explained, “we’ve seen a large number of companies look at how they can expand out of large metropolitan, central hubs.” Rankin explained that the supply isn’t there yet in suburban markets.

“We’ve seen a spike in interest for flexible workspace. 5 out of our top 13 global coworking markets are now showing interest levels higher than pre-Covid-19. The bounce back is starting to speed up.”

Technology Insights & Predictions

Last but not least, Harley closed the Bitesize series with a summary of his predictions and insights that Yardi has taken from clients in the industry. “The future of flexible workspace is healthy and positive,” Harley states.

Harley is of the opinion that corporate companies will change their business models as a direct result of these unprecedented times. “Their employees will demand flexible working.” He compared this to Yardi’s own use of The Office Group in London, explaining that these beautiful office spaces make it easier for corporations to remain flexible.

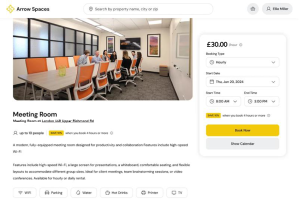

Revenues from meeting room bookings and services have “fallen off a cliff” in Harley’s opinion. “Treat the service revenues as a bonus,” he continues. Harley explained that those flex space providers relying on the additional service income might struggle in today’s world and that they need to establish stronger fundamentals.

“Your members will now expect a digital experience that is as good as the physical customer service the industry is known for.” Harley explains that not only will members now expect apps and easy booking systems, but operators must consider management technology that sees them keep spaces clean, safe and profitable.